Millennials express considerable concern about their personal financial situation today, although their concern is somewhat less today than one year ago. The newly released iOme Measure of Millennials 2013 national survey finds that 43% of Millennials today say they are Very Concerned about their personal financial situation; in the 2012 survey, that percentage stood at 58%. In this most recent study 28% say they are Moderately Concerned (23% in 2012) 19% say they are Somewhat Concerned (12% in 2012), 8% are Not At All Concerned (5% in 2012) and 3% are Not Sure (3% in 2012). The concerns of Millennials are well founded as the great recession, although technically over, has taken a significant toll on Millennials.

Unemployment is historically somewhat higher among Millennials, especially in the younger cohort of Millennial generation. Unemployment rates for those aged 18-19 in August 2013 was at 21.2% (22.7% in August 2012) and among those aged 20 to 24 the unemployment was 13% (13.9% in August 2012) well above the rate of 6.3% (6.8% in August 2012) among those 25 -54 years of age according to the latest Bureau of Labor Statistics. “It appears that the easing of the recessionary period is having a positive impact on Millennials. They seem to be slightly less concerned than they were in 2012 and the unemployment numbers justify that position,” said Adi Redzic, executive director of iOme Challenge.

When asked if they are financially better off, worse off or about the same today compared to one year ago, 25% (23% in 2012) say they are better off, 25% (30% in 2012)say they are worse off, 47% (43% in 2012) say they are about the same and 3% (4% in 2012) are not sure. Regarding their views on how they will be doing financially one year in the future Millennials continue to be optimistic with 39% saying better off, but they are not as optimistic as they were in 2012 when 48% said they would be better off. In 2013 10% say they think they will be worse off next year and 42% say they will be about the same one year from now. In 2012 12% said they would be worse off and 29% said they would be about the same.

Millennial concerns about the current financial situation facing the U.S. have been muted slightly. In 2013, 41% say they are Very Concerned about the financial situation facing the U.S. today. The level of concern is slightly lower than in 2012 (45%) and 2011 (46%). The 2013 iOMe Measure of Millennials study finds that 31% say they are Moderately Concerned (33% in2011, 30% in 2012), 20% say Somewhat Concerned (16% in 2011, 17% in 2012) 4% Not At All Concerned (2% in 2011, 3% in 2012) and 4% are Not Sure (3% in 2011, 5% in 2012).

Men (43%) are somewhat more likely than women (40%) to say they are Very Concerned about the U.S. financial situation and women (47%) are more likely than men (39%) to say they are Very Concerned about their personal financial situation.

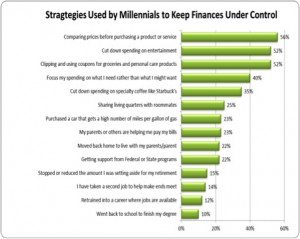

Millennials are aware of the sometimes severe limitations on their financial resources and utilize several strategies to help keep their personal finances under control, but the hard decisions to put money aside for the future or continue their education is taking less precedence over tightening their spending habits. Over half 56% take pride in comparing prices before making purchases; 52% have cut down on entertainment expenses and 52% use coupons when shopping.

Other strategies include focusing purchases on what they need instead of what they want (40%); 35% have cut down on purchasing specialty coffees; 25% share housing expenses with roommates; 23% each say their parents or others are helping to pay their bills or they have moved back in with their parents; 23% of millennials say have purchased a car that uses gasoline efficiently; 22% are getting support from Federal or State programs such as food stamps. Fifteen percent have stopped or reduced the amount they set aside for retirement; 14% have taken on a second job in order to make ends meet; 12% went back to school to get retrained into a career where jobs are available; 10% went back to school to finish their degree.

Education seems to influence some of these financial decisions. Those who attend post-secondary school (34% verses 21%) are more likely to share living quarters with a roommate and acquire a second job (19% compared to 13%) in order to pay their bills. Almost 30% of those with at least some college experience choose higher fuel-efficient cars. Over two thirds (67%) of those with a Masters Degree say they compare prices before making purchases compared to only 20% of those with a high school diploma.

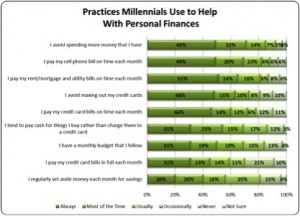

Seventy-one percent of Millennials avoid spending more money than they have Always (49%) or Most of the Time (22%); 69% pay their cell phone bill on time Always (49%) or Most of the Time (20%); 65% pay their rent and utility bills on time Always (51%) or Most of the Time (14%); 63% avoid maxing out credit cards; 60% prefer to pay cash; 50% have a monthly budget they follow; 45% pay their credit card bill in full each month; 40% regularly set aside money each month for savings.

Differences among genders are seen in some areas of financial decision making such as paying off credit cards in full each month; men (52%) are much more likely to pay their bills in full compared to 38% of women.

In almost all instances older and more educated Millennials appear to be making better personal financial choices. Forty-five percent of those enrolled in post-secondary education set aside money each month for savings compared to 38% of those not enrolled. Twenty-seven percent of those with less than a high school diploma and 69% of those with a Masters Degree regularly set aside money each month. Twenty-seven percent of those with less than a high school diploma and 82% of those with a Masters Degree pay their credit card bills on time.

Fifty-one percent of Millennials say they Favor an Automatic Individual Retirement Account (Auto-IRA) program where a certain percentage of their income would be automatically taken out of their check and placed in an IRA. Only 17% Oppose this idea, but 32% are Not Sure how they feel. Almost half (49%) of those who think that Social Security will not exist when they reach the age of 67 Favor Automatic Individual Retirement Accounts, 32% of those that believe Social Security will exist when they reach the age of 67, but the benefits will be much less than they are for today’s retirees, Favor Automatic Individual Retirement Accounts and 9% each of those that think Social Security will exist when they reach age 67 and the benefits will be about the same as they are today and those who are Not Sure about Social Security Favor Auto IRSs although this is not statistically significant.

Looking into the future, Millennial’s are doubtful about the sustainability of Social Security and their attitudes remain steady from a year ago. The newly released iOme Measure of Millennials 2013 national survey finds that 43% of those between the ages of 18-32 years old say they don’t believe Social Security will exist when they reach age 67, 32% expect Social Security will exist when they reach 67, but the benefits will be much less than they are today. Eight percent say Social Security will exist when they reach 67, but the benefits will be about the same as they are today. Understandably, 17% say they are Not Sure what to expect from Social Security when they retire. These results are almost a mirror image of the results from the Measure of Millennial survey in 2012.

A greater percentage, almost half (48%), of all female respondents doubt that Social Security will even exist when they reach age 67 compared to 39% of men. About the same number (30% of woman and 33% of men) feel the program will exist, but the benefits will be less. Twice as many men (10%) as woman (5%) say benefits will remain the same and an equal amount (16% women and 17% men) are Not Sure.

Education is once again related to responses with 60% of Millennials currently enrolled in post-secondary school Favor an Auto IRA program compared to 47% of those not enrolled. Thirty-five percent of those not enrolled are Not Sure if they support an auto IRA program compared to 24% of Millennials enrolled in post-secondary school.

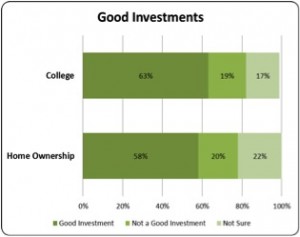

Five years after the fall in the housing market 58% of Millennials say owning a home is still a good investment. The majority (50% – 78%) of older Millennials support home ownership, whereas 42% – 43% of 18 and 19 year olds give their support and 33% – 43% of these groups say they are Not Sure. Eighteen percent of millennials say it is no longer a good investment and 16% admit they are Not Sure. This compares to 81% of the general public who said they believed buying a home in 2011 was the best long term investment.

Ever increasing cost of college tuition has also taken its toll on attitudes toward education, but Millennials show slightly more optimism about investing in education. Almost Two-thirds (63%) of Millennials say attending college continues to be a good investment. Predictably, the majority of those enrolled in post-secondary school (76%) and those who have attended post-secondary school are more likely to say college is a good investment.

Ever increasing cost of college tuition has also taken its toll on attitudes toward education, but Millennials show slightly more optimism about investing in education. Almost Two-thirds (63%) of Millennials say attending college continues to be a good investment. Predictably, the majority of those enrolled in post-secondary school (76%) and those who have attended post-secondary school are more likely to say college is a good investment.

In contrast, a 2011 report from the Pew Research Center says that less than half (43%) of the general public feel that the United States higher education program provides students with good value for their money.

Millennials do not have a great deal of confidence in our political leaders to solve the financial issues our nation is facing. One-third (33%) say they are Very Confident (11%) or Moderately Confident (23%) in President Obama to solve the country’s financial problems, 20% are Somewhat Confident, 40% are Not At All Confident, and 7% are Not Sure. Twenty-seven percent say they are Very Confident (10%) or Moderately Confident (17%) that Democrats in Congress can solve the financial issues facing the U.S. today, 27% are Somewhat Confident, 35% are Not At All Confident, and 11% are Not Sure.

Support for the Republican Party is slightly weaker among Millennials. About a quarter (26%), are Very Confident (9%) or Moderately Confident (17%) that Republicans in Congress can solve the financial issues, 26% are Somewhat Confident, 37% are Not At All Confident and 12% are Not Sure.

The 2013 iOme Measure of Millennials national survey finds that financial concerns of Millennials have eased slightly, but Millennials are still quite concerned about their personal financial situation as well as the nation’s financial situation.

The analysis in this report is based on a national online representative sample of adults aged 18-32 in the United States. The survey was implemented in partnership with Toluna research (www.toluna-group.com). The online survey was conducted September 11-13, 2013. The representative sample included 618 completed surveys. The questionnaire was designed and hosted by the St. Norbert College Strategic Research Institute (www.snc.edu/sri) using Qualtrics software. Respondents for this survey were selected from among those who have registered to participate in Toluna’s online surveys and polls. The data have been weighted to reflect the age composition of the millennial generation. Because the sample is based on those who initially self-selected for participation in the Toluna rather than a pure probability sample, no estimates of sampling error can be calculated. All sample surveys and polls may be subject to multiple sources of error, including, but not limited to sampling error, coverage error, and measurement error.