One of the most important foundations of investing is diversification. The term in itself is relatively simple to understand – holding a variety of investments within a portfolio – but more questions arise when it comes to the process of diversification. How many different investments are enough? 2? 200?? 2,000?!? Is it enough to just invest in American companies, or should we invest in companies around the world?

I want to discuss the importance of diversification with a little investment scenario:

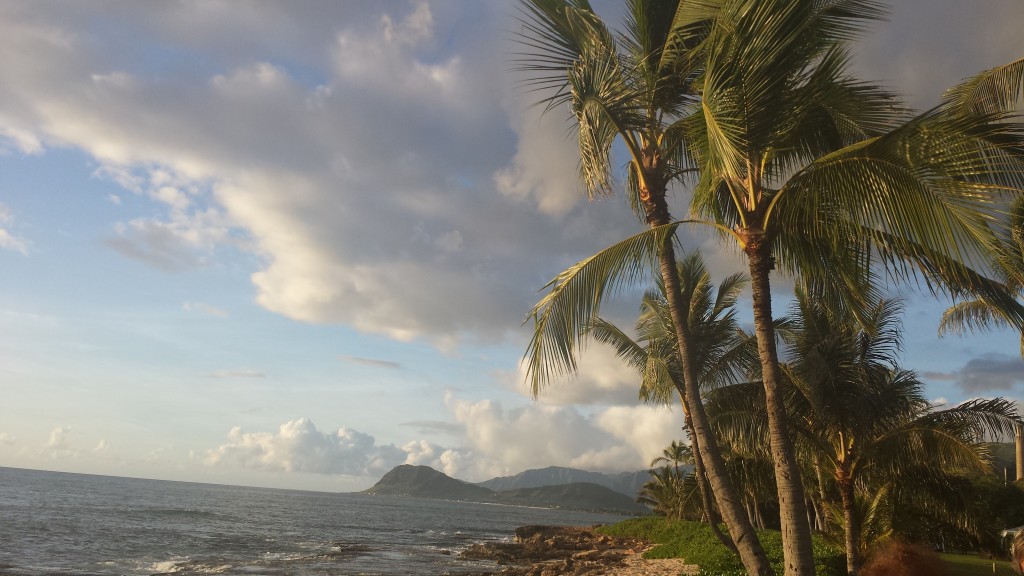

Imagine that you are making an investment in the Hawaiian Islands, and you have decided to purchase stock in a company that sells sunscreen. You feel that you can never lose with this investment because the sun is always shining! But then something happens that you forgot to account for – the rainy season, which brings with it torrents of rain that last for days. The sun isn’t shining, no one is going to the beach, and no one is buying sunscreen. Your investment in the sunscreen company starts to lose money.

Thankfully, the rainy season ends, and your sunscreen investment begins to improve, but you want to stave the losses that you experience during the rainy months of the year. So you decide to allocate some of your investment toward a company that sells rain gear and ponchos to the unsuspecting tourists who have visited the islands during the rainy season. Without the investment in rain gear, you would have always experienced a loss when sunscreen wasn’t selling. Now, when the rainy season hits Hawaii, your rain gear investment makes the losses you experience from your sunscreen investment hurt less.

Because your investments in Hawaii are doing so well, and the rainy season taught you not to put all of your eggs in one basket, you decide that it wouldn’t be a bad idea to invest in some companies on the mainland. Then, the unthinkable happens – a tsunami hits Hawaii and plunges the islands beneath the ocean. Because you invested in companies on the mainland, the impact that the tsunami could have had on your investments isn’t as bad as it may have been.

What this simplified scenario demonstrates is the importance of investing in more than one industry (sunscreen and rain gear) and the importance of investing in more than one arena (Hawaii and the mainland). When we diversify our investments, we are working to protect ourselves against risks from one company, industry, or country. This type of risk is referred to as unsystematic risk – risks specific to a company and that exist outside of the market.

In our next blog post, we’ll get into a few more investment terms: allocation, reallocation, and rebalancing.